The Gateway to Easy use Payment Processing is Here

The days of complex payment gateways are behind us. This summer, OMEGA Processing Solutions rolled out a new payment gateway option with PayTrace. Along with PayTrace’s extensive list of products and features, PayTrace’s biggest marketplace advantage is the ease and lower cost of Level II and Level III qualifications for B2B and B2G merchants – saving you money.

What is PayTrace?

Simply put, PayTrace is a payment gateway providing comprehensive, easy-to-use payment processing solutions to your OMEGA account. PayTrace’s products and features include:

- Point of Sale: Simple payment processing that allows you to accept payments with or without a card.

- Mail and Phone (MOTO): Card-not-present processing with secure customer storage vault, B2B interchange

savings and other features.

savings and other features. - E-commerce: Secure website integration and card processing with B2B interchange savings and developer-friendly APIs.

- Mobile PayTrace GO: 2-in-1 mobile solution allows swiped and keyed sales transactions with full virtual terminal functionality

- Cash Advance: Web-based cash advance systems for financial institutions, eliminating the need for expensive, countertop terminals.

Knowing all businesses have different needs, PayTrace has four product offerings – Basic, Pro, Pro with EMV, and Cash Advance. Each product enjoys the same five-star support from OMEGA Processing Solutions and PayTrace.

Level II and III Interchange Savings

The most important advantage PayTrace offers the marketplace is the interchange savings with Level II and III data.

Interchange Refresh

When it comes to qualifying for lower interchange fees, the general rule of thumb is “the more information, the better.” Nowhere is this more true than B2B and B2G transactions. By including additional data, these transactions can qualify for lower interchange rates. The problem is, the higher the level, the more data required (tax amount, customer code, merchant postal code, tax identification information and much more).

PayTrace’s Solution

PayTrace improves and simplifies the Level II and III interchange qualification process, making it simpler to qualify for interchange savings. The platform identifies which transactions from adding Level II and III data, intelligently calculating, and pre-populating fields. Common interchange reductions are around 0.50% lower than typical sales for Level II while Level III interchange rates are often 0.80-1.00% lower than their standard counterparts. You can see a B2B merchant processing large orders would greatly benefit from data input!

How Does It Work?

The sophisticated platform is able to notify you in real time if a transaction may benefit from Level III data, eliminating the need to add information to transactions that would not benefit. PayTrace auto-fills your personalized default Visa and MasterCard templates, and highlights what might need to be added. You can view and configure any additional data to your pending settlements with ease, allowing for lower interchange rates and putting more money in your pocket. It works in tangent with your OMEGA merchant account to automatically qualify your cards at the lowest possible interchange rates.

Concerned Learning a New Gateway Will Be Difficult?

Don’t be! OMEGA’s Customer Service Team has been highly trained in helping our merchants get the most out of our products and services. We build the account to YOUR specifications, train your employees, and always follow up to make sure the full savings is being realized. Additionally, PayTrace has a considerable library of demonstration videos available for training and support. The company has also developed a PayTrace blog as a resource. The time and money you’ll save through their user-friendly platform and decreased interchange rates will be worth it.

Call OMEGA Processing Solutions at 866.888.9724 Ext. 7 for more information and a product demonstration.

*Level III Data not available on Basic option

Posted by POSitive Processing

Posted by POSitive Processing

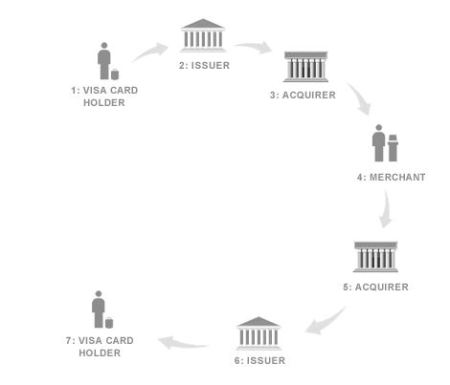

OMEGA Processing’s customer service will reach out to our merchants when we receive notice of a pending chargeback to help resolve the issue.

OMEGA Processing’s customer service will reach out to our merchants when we receive notice of a pending chargeback to help resolve the issue.